Tariff schedule: The US has imposed duties on medicines and copper

The global trade war continues to flare up: the United States has imposed large-scale duties in several areas at once. 50% will be charged on copper imports, and 200% on medicines at once. The figures are not final, but they are very eloquent. At the same time, a 50% tariff was imposed on all Brazilian products. The United States has firmly set its sights either on relocating production facilities from around the world to its home, or on replenishing the budget by hundreds of billions of dollars a year. But this will lead to higher prices for many goods and the collapse of the global economy. Details can be found in the Izvestia article.

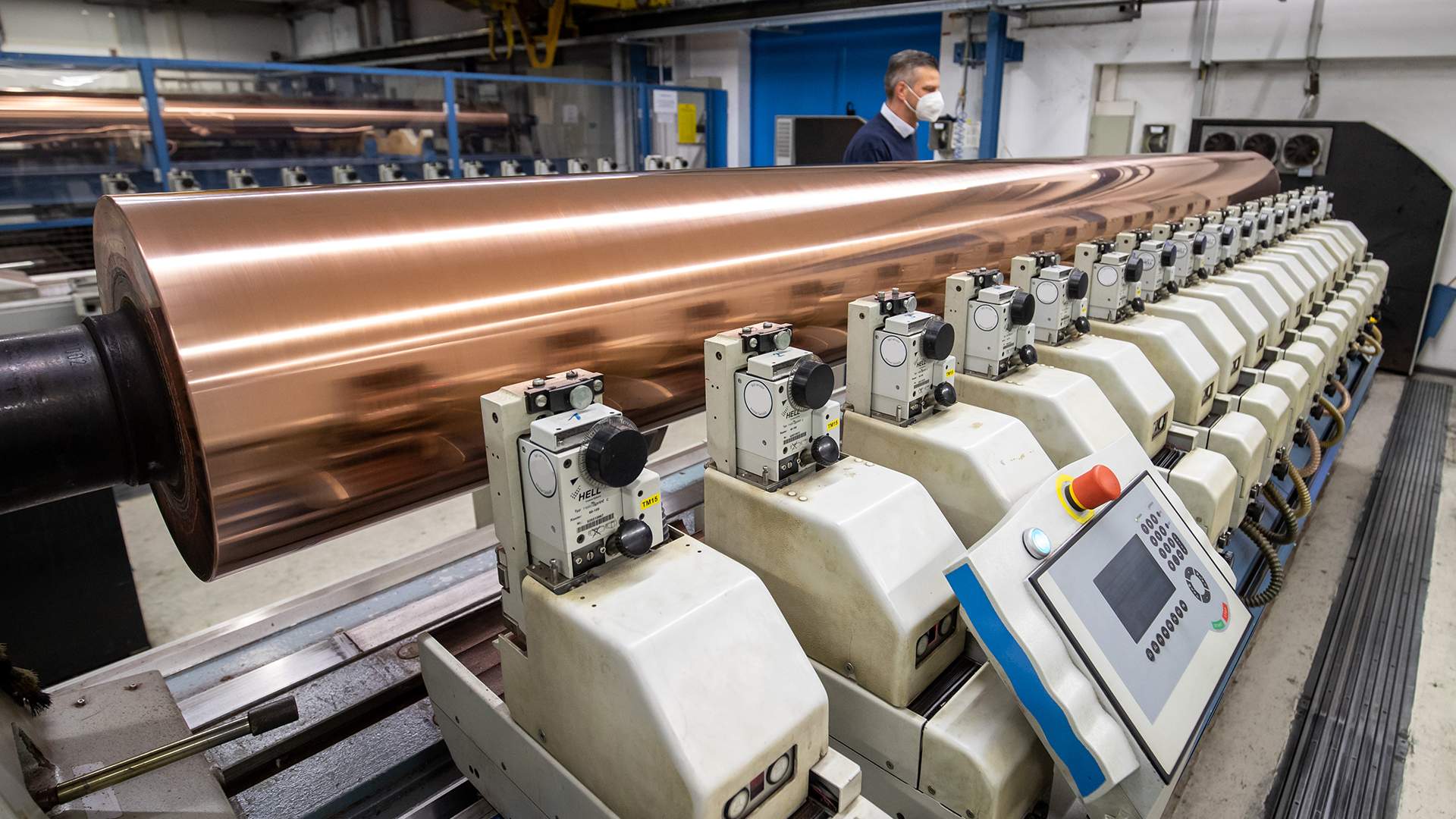

Copper pipes

Trump's decision to immediately impose tariffs of 50% on copper imports was completely unexpected. This is perhaps the loudest salvo in the ongoing trade war this month. Prior to that, there were practically no duties against the supply of minerals and direct products of their processing (with the exception of aluminum): oil and many non-ferrous metals have been removed from their operation. On the contrary, it was China that began to limit the supply of its rare earths to the United States.

In fact, in this case, the decision of the American administration has its own understandable reasons. The US is very concerned about dependence on foreign copper. This metal is vital for key sectors of the economy. Firstly, it is the second most important element used by the US Department of Defense for most types of military products. Secondly, it is necessary for the creation of semiconductors, lithium-ion batteries, data centers and a variety of complex electronics. All of these are strategic industries that the United States, under Trump's leadership, wants to protect from external risks (how serious is the cause for concern is the second question).

Currently, imported copper covers about 45% of American needs. At first glance, this figure is not critical, but in 1991 it was zero. During the period of rapid globalization, a significant part of copper mining and processing was withdrawn from the country due to labor costs, environmental considerations, and others. But there is another caveat: the United States is the largest exporter of copper scrap. Scrap is mainly shipped to China and processed there into finished material, which is also used in the USA.

What can such a policy lead to? Prices have already skyrocketed: copper has risen in price by more than a third since the beginning of the year, and this week it soared in price by another 17% on the COMEX exchange in the United States. There is an interesting situation where there is a significant difference between prices in America and Britain (the second most important copper trading market). In recent weeks, American importers have been massively stocking up on copper in order to make it before the imposition of duties, which is scheduled for August 1.

The United States is unlikely to be able to quickly replace all foreign copper: the deployment of its own industry will take several years, although there are deposits and processing facilities in America. Due to the tariff policy, the export of scrap is likely to be limited. If prices jump too much or there is a threat of shortages, Americans can make some kind of relief. For example, there is an exception for Chile, which is the world's leading copper exporter. Nevertheless, we will almost certainly see the strongest volatility in this market in the coming months or even years.

There's room to move

Pharmaceutical products have so far been excluded from the "reciprocal tariffs" imposed by the US administration against other countries, although, for example, medical equipment is fully subject to duties. There has been talk that this "flaw" will be fixed in recent months, but the tariff rate of 200% has impressed all market participants. In fact, such a prohibitive duty forces most manufacturers to move production to America — there is a difference in cost, taking into account logistical costs, but it is still not that large.

The reason for the Trump administration to make this decision (or threaten it for now) was the enormous dependence of the national market on imports. In 2024, pharmaceutical imports to the United States amounted to $213 billion, or about 6% of all imports. A 200% duty will either ensure the same large-scale economic growth in the industry, or lead to hundreds of billions of dollars in revenue for the American budget — in both cases, the administration will benefit.

The downside of the process will be the inevitable rise in product prices. However, the Americans hope to stop this at the expense of two components. Firstly, the key costs in the creation of many medicines are research and development, that is, the production component of the cost is moderate. This means that sellers have a place to "move". Secondly, the White House hopes to push manufacturers to lower prices for medicines prescribed by doctors (which should be priced at the same price as their cost abroad). Actually, if the latter condition is fully implemented, the amount of duties may decrease significantly.

Manufacturers reacted quite nervously, and yet they massively announce plans for "reshoring" in the United States. For example, Eli Lilly intends to invest $27 billion in plants in America. Novartis and Sanofi have made similar promises. However, it is not yet clear how serious they are in their intentions or just demonstrating loyalty. In any case, perturbations of this magnitude will almost certainly lead to a redistribution of the global pharmaceutical market and an increase in prices for many types of medicines.

Carpet tariff bombing

Although deals have been concluded with China, Vietnam and some other countries in recent weeks, Washington's trade war with others is only escalating. This week, Brazil became the focus of attention, which the White House immediately imposed a universal tariff of 50%. The most interesting thing is that the South American country is one of those that has a trade deficit with the United States. That is, in the case of mutual duties, the United States will lose more than its counterparts.

The decision was linked to politics: Washington is unhappy with the persecution of former Brazilian President Jair Bolsonaro, who is a friend and ally of Trump. The White House has a strained relationship with the current leftist administration. Brazil has already promised to respond in kind. In general, the trade war will be quite painful for both countries and may push Brazil to strengthen trade and economic ties within the framework of the BRICS.

Brazil has firmly established itself in first place in the "standings" of countries against which US duties have been imposed and or promised to be imposed. The leaders are also the countries of Southeast Asia, as well as Bangladesh, Serbia and Algeria. Meanwhile, the deadline for reaching a trade agreement between the EU and the United States is nearing its end. A figure much lower than 50% could be absolutely catastrophic for the European economy, which is already going through difficult times. Preliminary information, however, suggests a minimum rate of 10%, from which some goods will be withdrawn, in particular, aviation and alcoholic beverages. But the Europeans will almost certainly have to pay for it. Everything will be finally clarified here only in August.

All these talks cannot cancel one thing — duties, which a year ago seemed an extremely unlikely prospect even if Donald Trump wins, have now become a reality. Negotiations are underway and will continue for a long time, but their subject has long been not the availability of tariffs in principle, but their rate and possible exceptions to the rule. The global economy is rapidly reformatting under pressure from a country that used to be the main proponent of the status quo. The fragmentation of global trade is becoming more and more inevitable.

Переведено сервисом «Яндекс Переводчик»