"Open Portfolio": how much private investors could earn in November

In November, the Russian currency weakened by 11% and went above the psychologically important mark of 100 rubles per dollar, the U.S. introduced new sanctions against Russian financial organizations, other companies and individuals, and the Ministry of Finance told about the prospects of several state-owned companies to enter the stock exchange. The main financial news and the dynamics of stock exchange assets - in the material of "Izvestia".

Results of the month

In November, the ruble exchange rate continued to decline against both currencies traded on the secondary market and those represented on the exchange - primarily against the Chinese yuan (at the moment the rate went beyond the mark of 15.15 rubles per yuan for the first time since the end of March 2022). Head of the Ministry of Finance Anton Siluanov explained such dynamics primarily by the new US sanctions.

The Ministry of Economic Development added that the observed exchange rate dynamics is not related to fundamental factors, as Russia's trade balance remains stable, and the share of the Russian ruble and currencies of friendly countries in import and export operations remains above 78%. Therefore, the weakening of the ruble is also largely due to the "excessive emotional component" of currency market participants, said the head of the agency Maxim Reshetnikov.

His words were confirmed almost immediately: in early December, the ruble began to strengthen. According to Deputy Prime Minister Alexander Novak, the Russian currency is looking for a balance point, but there are no preconditions for its further weakening.

As for the new package of U.S. sanctions against Russian organizations, more than 20 organizations from among banks have fallen under them. Several registrars and depositories, as well as financial intermediaries are also on the same list.

An important news for the stock market was the statement of the deputy head of the Ministry of Finance Ivan Chebeskov that the Russian authorities have identified a list of seven companies with state participation, which can go public through the IPO procedure. In general, by 2030, the Ministry of Finance expects that state companies will place their assets with a total value of about 1 trillion rubles.

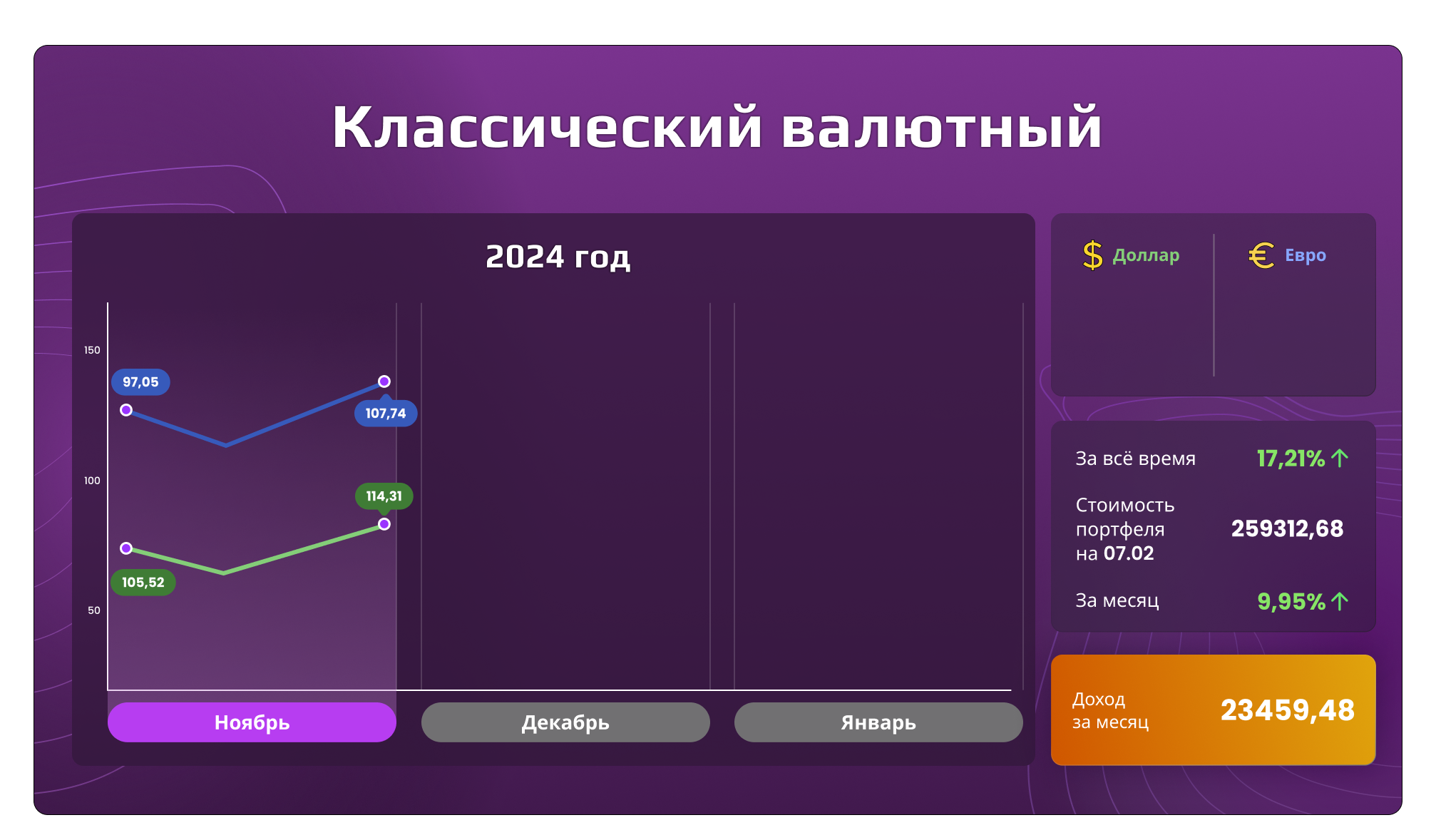

Currency under the pillow - dollars and euros

Over the month, the portfolio of dollars and euros increased in value by 9.95% to Br259.3 thousand. It showed the most significant growth of all other portfolios.

Finam analyst Ivan Pukhovoy notes that after the introduction of sanctions by the U.S. against Russian financial companies, the decline continued not only in the currency, but also in almost the entire stock market of the country as a whole.

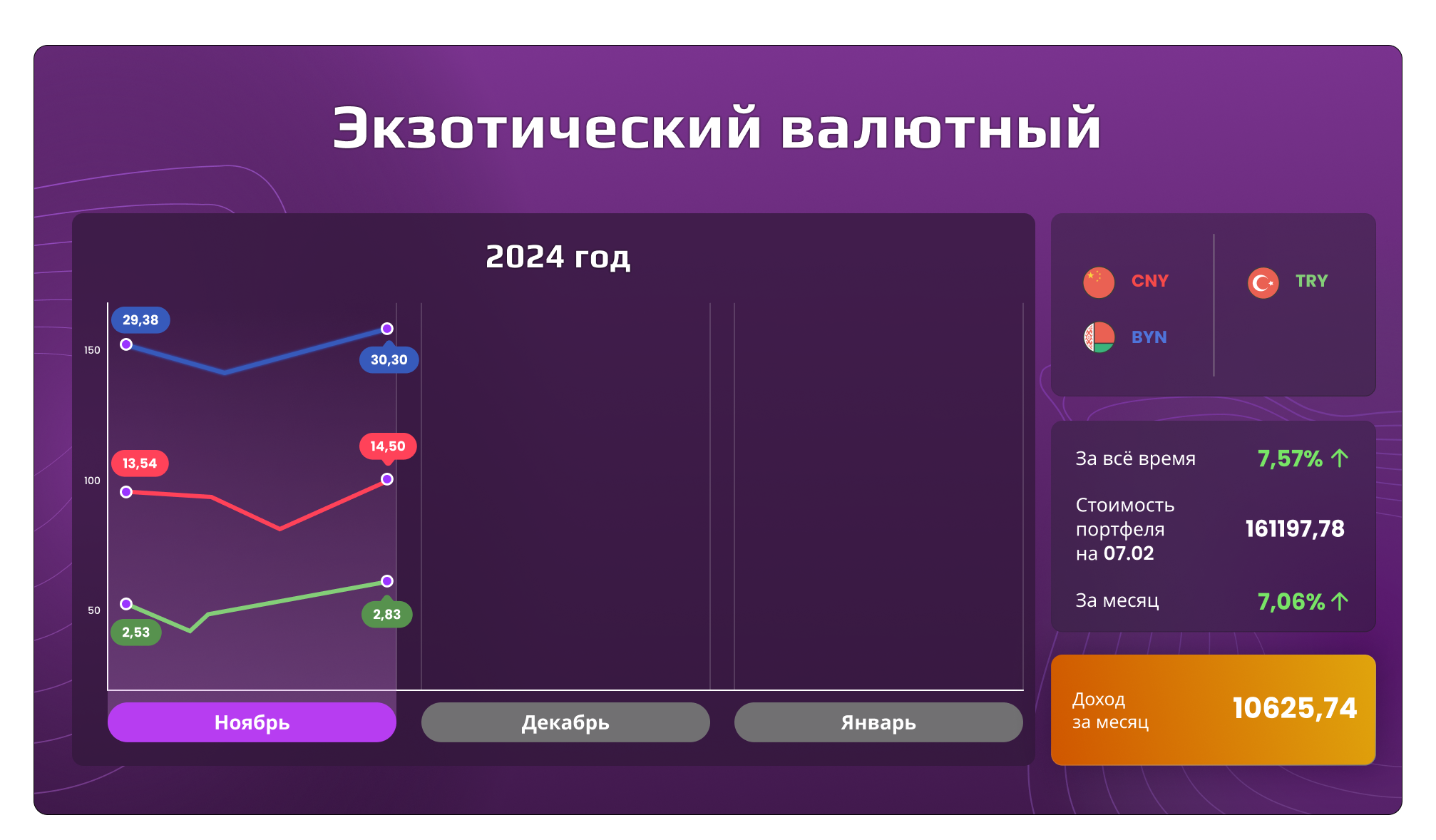

Few people saw them live - yuan, lira and Belarusian rubles

The value of the portfolio of exotic currencies also increased in rubles, though not so noticeably. Over the month, it added 7.06%, or up to Br161.1 thousand.

The overall dynamics of the portfolio was due to the same reasons. Among the unusual ones - the Turkish lira has regained its former ruble value after its fall relative to other currencies. But the Chinese yuan reacted to the weakening of the ruble the most.

Everything is like in a bank - five issues of government bonds with monthly payments

In November, the ruble value of the federal bond portfolio grew by 4.08%. In absolute figures, the indicator amounted to Br202.7 thousand.

In general, it can be noted that the price rebound was quite successful, however, it is too early to speak about a reversal in further dynamics. Such volatility of the portfolio may speak about the change of expectations of medium-term investors. The rate forecast for December still thickens the clouds in the short term, but it does not prevent from expecting its decrease next year.

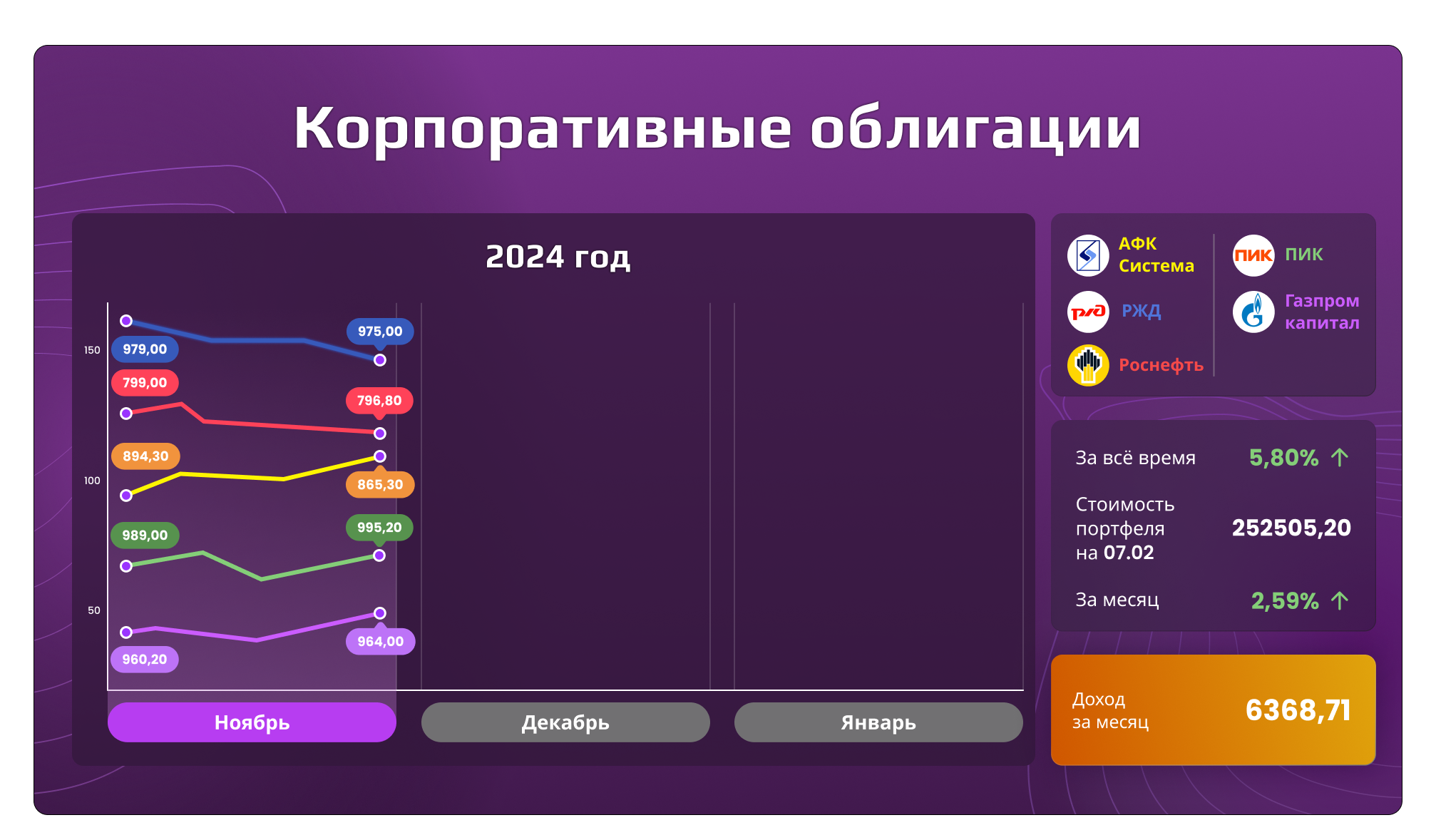

Large companies, not the Ministry of Finance - five corporate bond issues

The portfolio of corporate bonds did not rise in price as much as the OFZ portfolio, but the decline in its value last month was less pronounced. The positive dynamics amounted to 2.59% for the month - up to Br252.5 thousand.

Next month the bonds of PIK company will be redeemed - instead of them you can take the debt securities of the company "Positive". The issue with maturity in 2025 and yield to maturity of 24.6% will provide a decent yield.

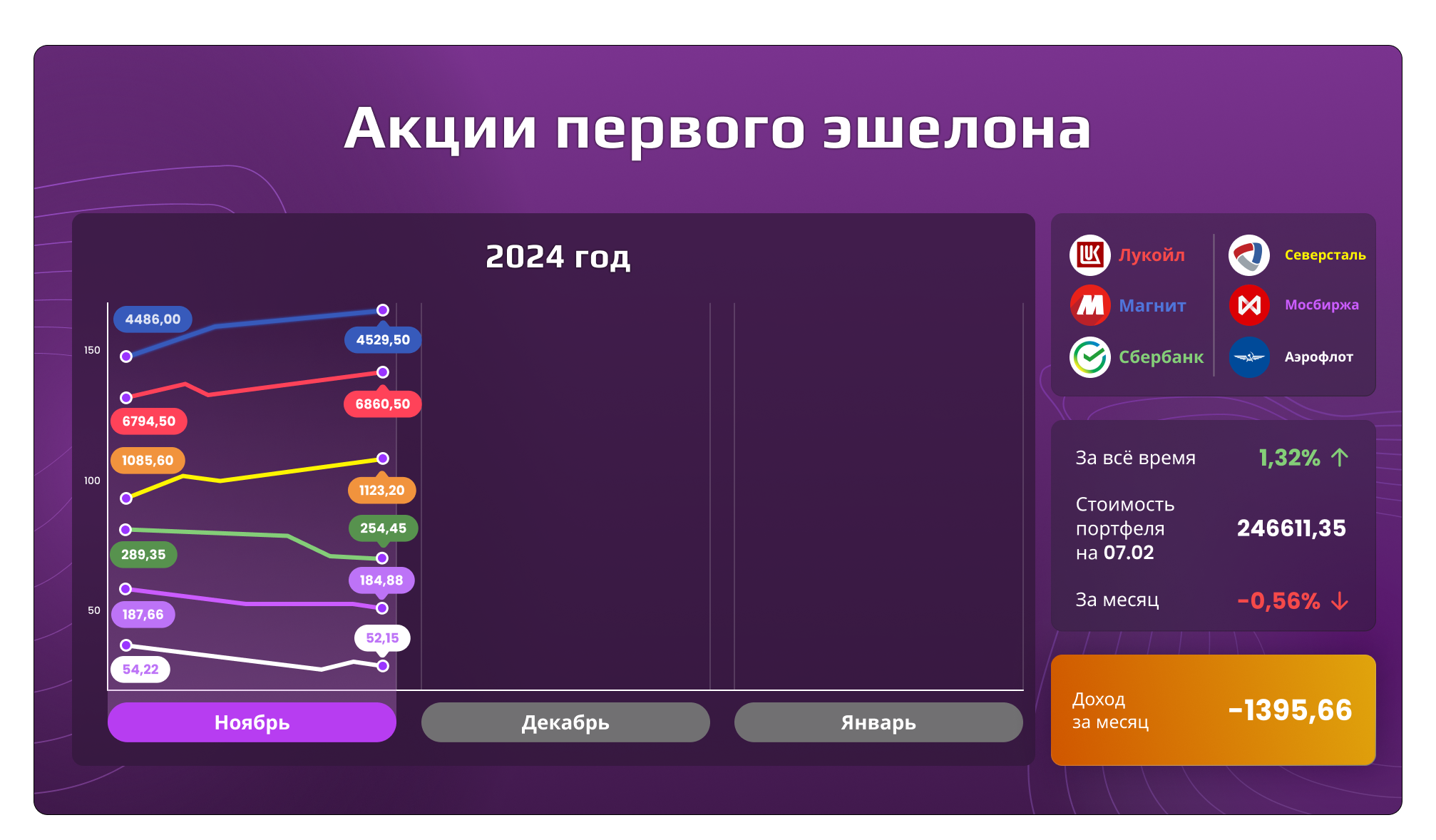

There is no better share than in the share - shares of Russian blue chips

The negative reaction of the market of liquid stocks to the new package of American sanctions was generally quite restrained - minus 0.56%. The total value of the portfolio at the end of November - 246.6 thousand rubles.

Finam notes that the Russian market expected the results of the elections in the U.S., after which it should have become clear whether the degree of geopolitical tension will decrease. However, after the next US sanctions against the financial sector of the Russian Federation, these expectations had to be postponed until better times.

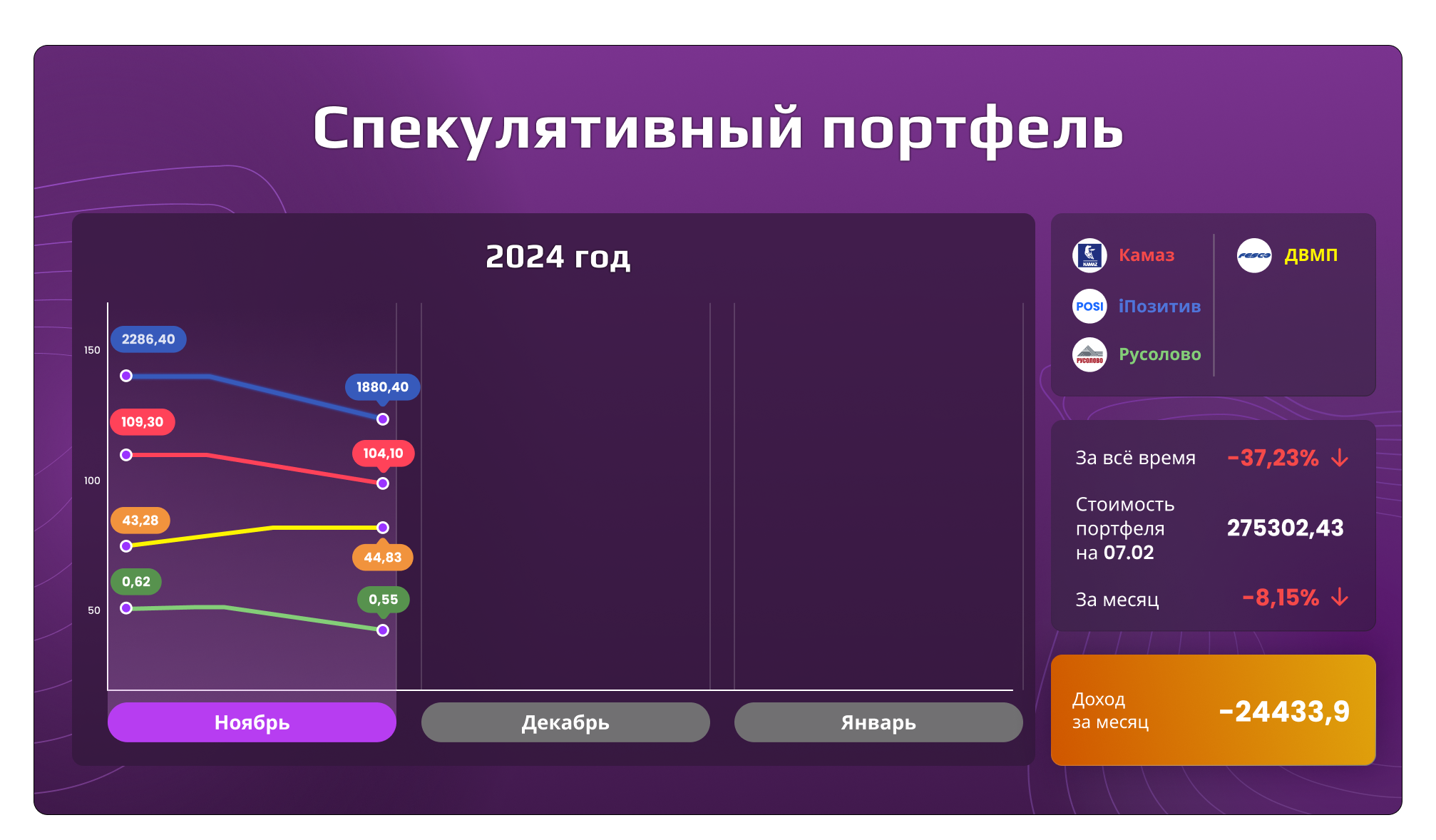

Eyes fear, but hands do - speculative stocks with high potential

The set of speculative stocks expectedly reacted to the negative factors much more strongly - in aggregate, the portfolio fell in price by 8.15%. Nevertheless, its total value by the end of the month amounted to 275.3 thousand rubles, which exceeds the figures for all other portfolios.

In general, investors should remember that negative market dynamics always affects more noticeably on low-liquid assets.

The opinions of analysts presented in this material, as well as the described examples of portfolios do not constitute individual investment recommendation (IIR).

Переведено сервисом «Яндекс Переводчик»